Inflation hedging assets – how “hedgy” are they?

Topic of the week:

Inflation hedging assets. How robust are they during high inflation? As the US Fed sets its highest base interest rate in 22 years, this week we look at 53 years worth of asset price data.

While it may seem obvious, we still need to get the boring stuff out the way first.

Disclaimer: None of the following is financial advice – everything we share is for entertainment purposes only. Past performance is not indicative of future results.

Hedging the inflation?

Inflation is a vital part of any economy, but not all inflationary periods are the same. "High inflation" refers to a sustained and significant increase in overall prices, often well above historical averages or central bank targets.

Our analysis will focus on the last 50 years of historical periods with significantly higher inflation rates to understand how traditional “inflation hedge” assets perform during inflationary stress.

The periods

The US Federal Reserve does not specify what “high inflation” means. However, most policy makers and economists aim to maintain circa 2% annual inflation for healthy economic growth.

In our analysis we will assume any periods with over 4% annual inflation as “high inflation”. Somewhat surprisingly, over the last 53 years, there weren’t that many periods which we could point at.

We’ll use the 70s and early 80s - this period was characterized by soaring energy prices, supply shocks and the persistence of high inflation rates. In 1979, inflation reached a peak of around 13.3%, which was one of the highest rates since World War II.

In the early 1980s, the U.S. economy faced another bout of high inflation, largely driven by the Federal Reserve's effort to combat stagflation by raising interest rates. In 1981, inflation peaked at approximately 10.3%.

We’ll also look at the mini-recession of the 90s, as well as, of course, the most recent disease-ridden period. And before you ask – during the 2008/09 financial crisis, the average inflation was just below our threshold at 3.84%.

The safe havens?..

During high inflationary periods the erosion of purchasing power of the currency can negatively impact traditional investments, such as equity or bonds, as their returns may not keep pace with soaring prices.

In contrast, “inflation hedge” investment assets, like precious metals, real estate and commodities are normally thought to show resilience in such environments.

Our comparables include:

“Stocks” - S&P 500 index;

“US 10-year Treasury Bills” – US sovereign 10-year fixed income;

“Real Estate” - Case-Shiller index;

“Gold” – year end price of 1oz unit of gold;

“Commodities” - S&P GSCI index.

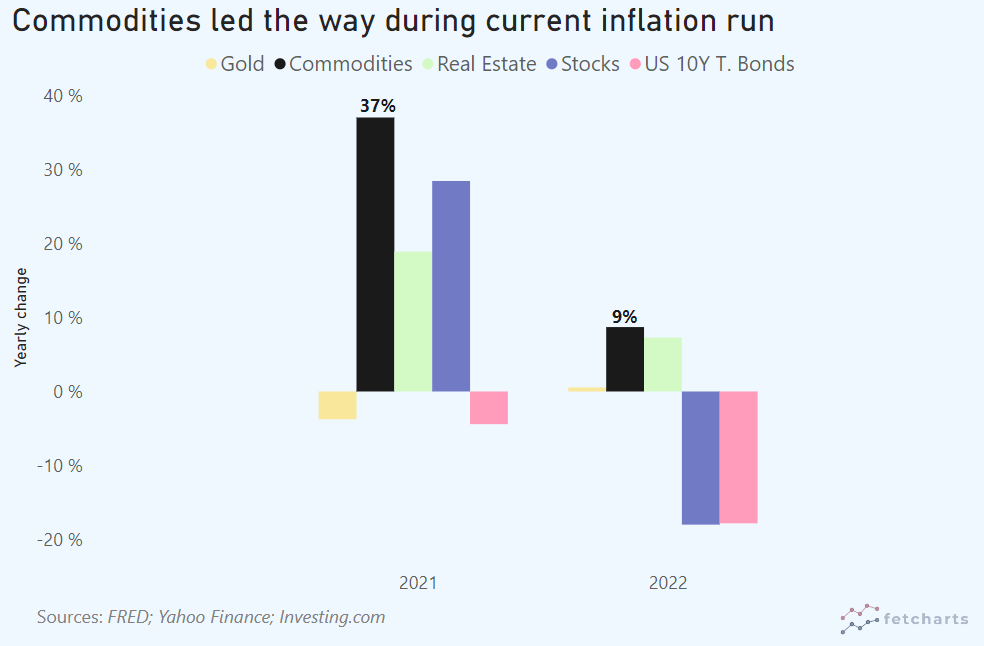

The graphs below show yearly price changes in each of our comparable asset classes throughout high inflation periods.

So what?

Contrary to popular perception, our graphs reveal that hedging assets did not perform as optimally as one would expect. Historically perceived as a safe haven during economic uncertainty, gold exhibited mixed results during the periods covered. Whilst it did have good returns throughout the 70s, its performance was far from consistent for us to draw conclusions here.

So should you run to rebalance your portfolio during high inflation times? We think that our historical analysis signals a need to revalue long-held assumptions about traditional inflation hedge assets.

Whilst one could argue that our chosen period is relatively short, we should also note that during standard inflation periods, US stock returns crush metals, broader commodities or real estate returns. That’s a total of 35 out of the last 53 years analyzed. Make of that what you will.

That’s all folks, see you next week!

Want no BS, witty insights about the Economy, Finance and Tech Start ups with clear visuals weekly?

Sign up for free below.

Want smaller chunks of bit-sized charts? Check out our Instagram below.