(3) Trillion Dollar Club

Topic of the week:

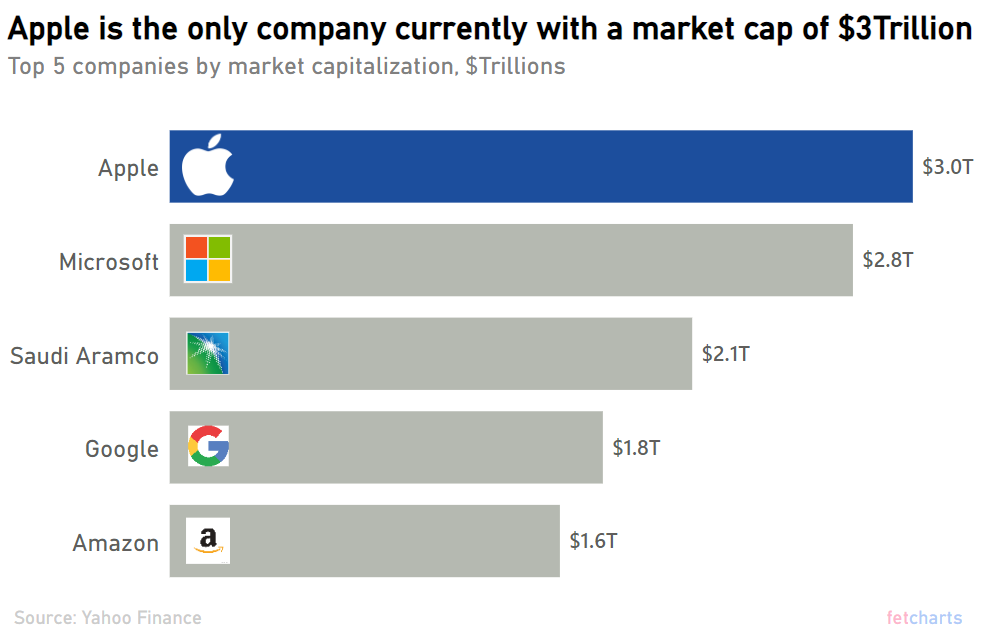

At the moment, the three-trillion dollar club consists of a member of one when we’re talking about the market capitalization of public companies. You guessed it, that company is your favourite phone maker (you may even be reading this newsletter through it right now) - Apple.

Disclaimer: this is not financial advice. All the information shared here is only for informational purposes. Past performance does not guarantee future results.

A giant amongst giants

To put it in perspective, the $3T market capitalization of Apple is roughly the same as the GDP of United Kingdom. Some analysts are even projecting that the market cap of Apple will reach $4T by 2025.

There is a close second runner that will join the three-trillion dollar club relatively soon (if nothing crazy happens), so for now Apple can enjoy being the lone wolf of the exclusive club. Or, until it reaches $4T and stands out from the rest again.

While today it may seem that Apple is smooth sailing and almost everything that they touch turns into gold, Apple’s road to the top was nothing short of a roller coaster.

Apple was founded in 1976, and it faced several bankruptcies along the way in the “old” days back in the 20th century. The co-founder and tech-innovation icon of the modern age, Steve Jobs, was ousted by the company in 1985, until he re-joined in 1997. A decade later after Steve Jobs re-joined Apple, the first iPhone was introduced to the world, and the rest was history.

A cash generating machine

Today, Apple is a cash generating machine firing on all cylinders. For almost every 4 dollars generated in revenue, Apple turns it into 1 dollar of free cash flow.

The company also has a low cost of debt of approximately 3.62% (measured as cash paid for interest / gross debt). While part of it can be explained by the fact that Apple managed to fix their rates on a portion of their debt prior to the steep interest rate raises (which we covered in one of our previous issues), the other part reflects a strong balance sheet and financials.

From a credit ratings perspective based on S&P Global, lending money to Apple is just as safe of an investment as buying United States treasuries, both having AA+ credit ratings (keeping in mind that Apple has additional idiosyncratic, or in normal people vocabulary terms, individual risks that may not be applicable on a geographical or national level).

Apple’s return on invested capital (ROIC), which essentially means how efficient the company is in using its assets to generate earnings, was over 80%, based on Apple’s financials from the latest few annual filings.

So in theory, if Apple can borrow money at ~4% rate, while producing returns at >80% rate, it means that using leverage is actually beneficial for them, as they can cover their interest payments, re-invest that money and generate excess returns after repayment. Of course, this cannot be done on an infinite loop, as at some point the ROIC levels off and it won’t be beneficial to keep borrowing money.

More than than just the iPhone

Even though Apple’s top line growth contracted in the last few years and was even negative in 2023, it continues to find ways to grow its certain sub-category revenues. In 2023 all the hardware related revenue segments (iPhone, Mac, wearables, etc.) experienced declines year-over-year, while services grew by 9%.

It makes sense that for the most prominent phone producer in the world already having a significant portion of the market share, selling significantly higher volumes of phones is probably not possible simply due to the supply and demand of the market.

Services (such as iCloud, Apple Pay, Apple Care, etc.) on the other hand, have a lot more room for growth, and the margins are also significantly higher due to the software-nature of the business segment.

Apple vs Apple vs The World

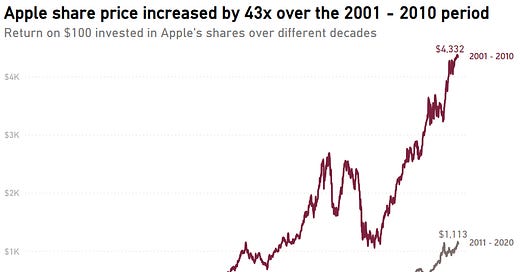

It’s evident that Apple is a well-oiled machine with a prominent brand. So how did the returns for such a company look over its lifetime, and did it beat the broader market?

So what?

Apple is the sole company to have reached the three-trillion dollar market cap mark thus far. Such a feat does not happen coincidentally, and is well supported by the company’s financials, ability to innovate, well-known brand and history of producing solid shareholder returns.

It seems that the current Apple product list may be entering its peak phase, or at the very least the growth is contracting. However, to pick up some of the slack Apple has its services category. And who knows, maybe in the future the tech giant will surprise us with another revolutionary product, as it did in 2007.

There’s always some gossip on the street that Apple is working on a new category or product. In the past we constantly heard about the possibility of an Apple car, and even though this idea seems to have been killed, who knows what the future holds.

With Microsoft next in line to join the three-trillion dollar club, who do you think will be the next companies to join this exclusive list?

That’s all for the this year, see you in the New Year!

Want no BS, witty insights about the Economy, Finance and Tech Start ups with clear visuals weekly? Sign up for free below.