Spotify (un)wrapped

Topic of the week:

In tandem with Spotify’s annual Wrapped campaign, we’re going to dive into the data of the music streaming market, and wrap up by covering the industry’s leading music streaming provider - Spotify, sprinkled with some insights and commentary about its stock.

While it may seem obvious, we still need to get the boring stuff out of the way first. Disclaimer: this is not financial advice. All the information shared here is only for informational purposes. Past performance does not guarantee future results.

Grab your earphones, and let’s get into it.

State of the music streaming market

Although the music streaming industry is not as lucrative as the video one when comparing the market sizes (we covered video streaming in the previous issue), it’s just as engaging, if not more, as the average listener spends around 20 hours per week on music and podcasts.

Nowadays music streaming is the main monetization channel bringing in the most revenue for the music industry.

In terms of the competitive landscape, at least from the count of companies perspective, the music streaming industry has a relatively small circle as >95% of the market is comprised of 7 companies.

Out of those 7 companies, almost 75% of global music streaming subscribers are represented by just 4 companies: Spotify, Apple Music, Amazon Music & YouTube Music.

The rise of Spotify

Spotify is the leader when it comes to music streaming, having around 32% of the market share. It was founded in 2006 in Sweden by two guys, Daniel Ek (who is currently the CEO of the company) and Martin Lorentzon (who holds a board member seat at Spotify). There’s even a Netflix TV series based on the two co-founders on how they built Spotify.

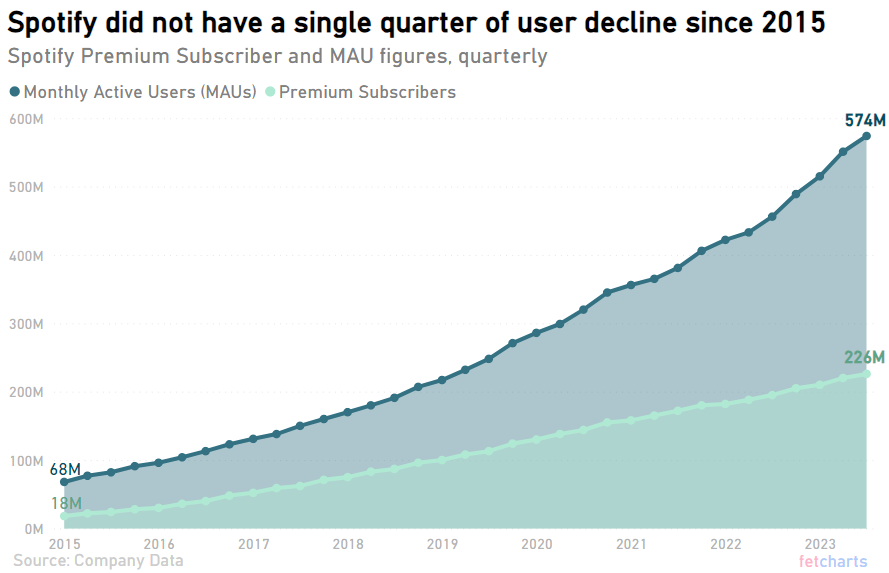

So far, there hasn’t been a single quarter since 2015 where Spotify’s number of premium subscribers, or even monthly active users (MAUs) have declined.

Quest for profitability

While it doesn’t seem that growth has been an issue for Spotify, profitability on the other hand, definitely has.

Recently the company announced it will release 1,500 employees (16% of its ~9,200 person workforce), including the current CFO. This is already the third time Spotify will cut its workforce in 2023, although the previous two layoffs were not of the same magnitudes.

The main reason for job cuts is that the CEO, Daniel Ek, wants the company to achieve profitability and operational efficiency, saying that currently “we still have too many people dedicated to supporting work and even doing work around the work rather than contributing to opportunities with real impact”. Basically, what Mr Ek is saying is that there’s no more free-loading going forwards.

We created a simple ‘back of the envelope’ discounted cash flow model (DCF) (for non-finance nerds, a DCF is essentially a model estimating the share price of a company based on its future cash flows) with several scenarios.

As we don’t have a crystal ball on our end, the goal was not to try and predict the stock price. Instead, the aim with this back of the envelope DCF was to try to reverse engineer what kind of growth and margins the market could potentially be pricing in regarding the stock price of Spotify. If you’d like, you can play around with the high level DCF here.

From the several scenarios we ran, it seems that the market may be pricing average annual top line growth of 15% over the next 5 years, as well as a move towards profitability: from -2% LTM EBITDA margin to approximately a 4.7% EBITDA margin in the distant future when the company is mature (reflected by the Terminal Year (TY) in the model).

While both assumptions seem logical and reflect the news from the street, company and historical financials, as always there’s arguments to be made on both sides.

And then the music stops.. or doesn’t?

As the last 4 year average revenue growth for Spotify was 22.3%, at first sight 15% annual top line growth for the next 5 years seems reasonable. However, it’s important to remember that Spotify is already the market leader, with ~32% of market share. While the company may as well continue its growth trajectory in the short-medium term, it cannot grow its revenue in double digits in perpetuity.

Even though growth hasn’t been an issue for Spotify as the company has managed to come up with creative ways to attract new users in the past (think of Spotify Wrapped, which has no real marketing costs associated with it and generated huge reach), the last few multi-million investments into projects like podcasts with the Obamas and Meghan Markle have flopped.

Move towards profitability

When it comes to profitability, it seems that Spotify still has quite some “fat” that it can trim to improve operational efficiency. While it seems that there’s not much that can be done about their costs of sales, which have been stable over the last few years as ~70% of the revenue goes to copyright owners, operating costs, on the other hand, can potentially be reduced.

The latest move towards cost efficiency was made recently when Spotify announced in December of 2023 that ~16% of its workforce will be laid off. It may be that Spotify took a chapter from some of the FAANG (Facebook, Amazon, Apple, Microsoft, Netflix, Google) companies, which laid off thousands of workers, which subsequently led to improved cost efficiency without any major glaring downsides so far (at least not visible to the public).

So what?

While the music streaming industry may not be the size of the gaming or video streaming markets, it’s still a sizeable one, which was estimated at $17.5B in 2022. It also appears that music is just as engaging, if not more, as the average listener spends around 20 hours per week on music and podcasts.

The music streaming market is controlled by only a handful of major players. Around 95% of the market share is represented by 7 companies, while just 4 entities have their hands on 3/4 of the market, with Spotify being the leading music streaming provider with ~32% of the market share.

While Spotify has been the industry leader for years and continuously growing its user and subscriber count every single quarter since 2015, so far it has not figured out a way to become a consistently profitable business.

At present day, it seems that the stock market is pricing in the continuation of double-digit top line growth for Spotify in the medium-short term, with the expectation of the company to be able to become consistently profitable, at least on an EBITDA margin basis, in the next few years with the focus on earlier, rather than later.

That’s all for this one, tune in next week!

Want no BS, witty insights about the Economy, Finance and Tech Start ups with clear visuals weekly? Sign up for free below.